Navigating the 2023 Health Savings Account Deduction

Introduction

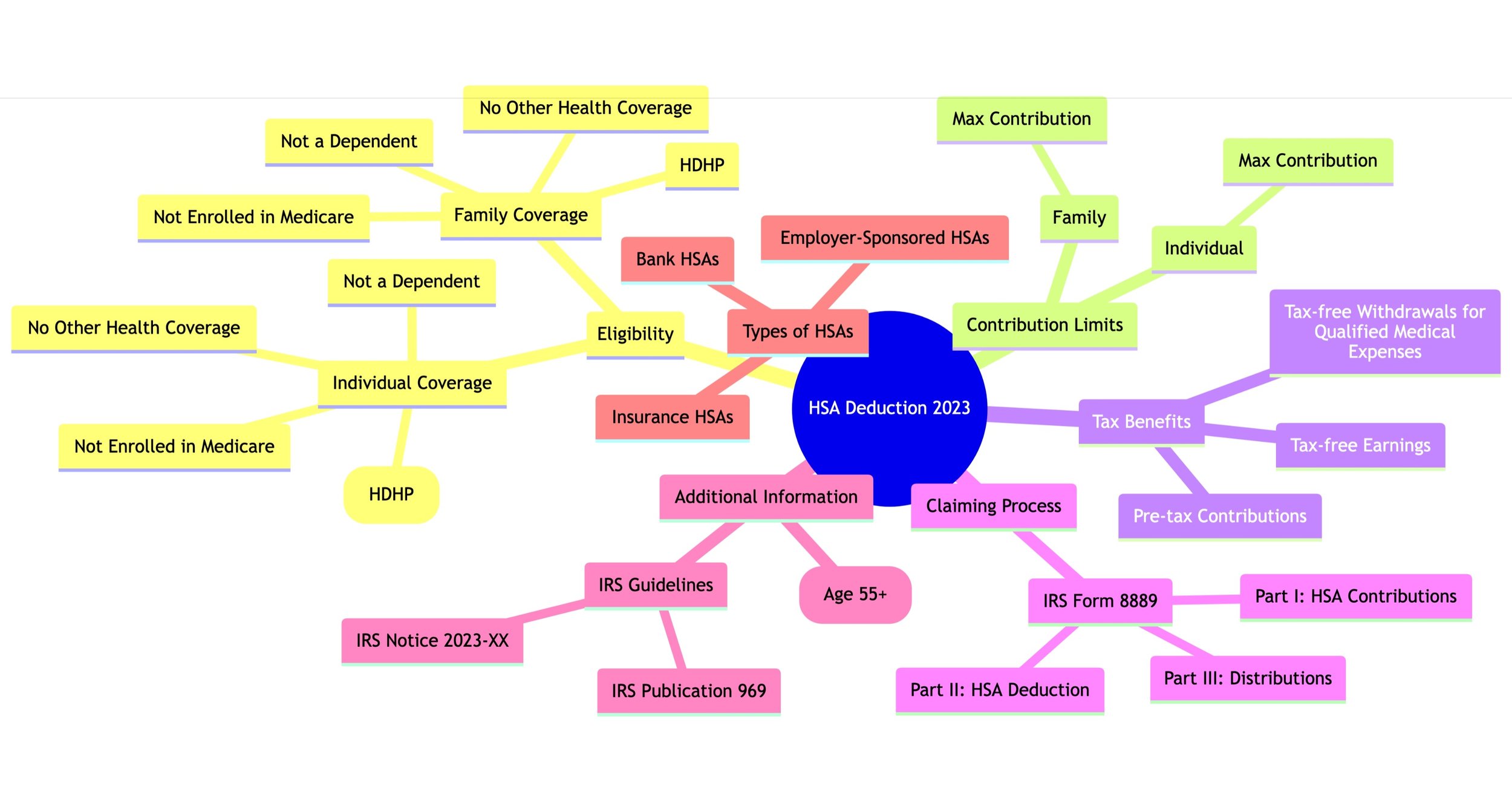

A Health Savings Account (HSA) is a powerful financial tool for managing healthcare expenses. The HSA deduction for 2023 offers tax advantages that can significantly reduce your taxable income. Here's what you need to know about qualifying for the deduction and how to claim it.

Eligibility for HSA Deduction

To be eligible for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP) and meet the following criteria:

No other health coverage: You cannot be covered by another health plan that is not an HDHP.

Not enrolled in Medicare: You cannot be enrolled in Medicare.

Not a dependent: You cannot be claimed as a dependent on someone else’s tax return.

Contribution Limits

The IRS sets annual limits for contributions to an HSA:

Individual coverage: The maximum contribution for individuals with self-only HDHP coverage will be specified by the IRS.

Family coverage: The maximum contribution for individuals with family HDHP coverage will also be specified by the IRS.

Tax Benefits

Contributing to an HSA provides three main tax benefits:

Pre-tax contributions: Contributions are made with pre-tax dollars, reducing your taxable income.

Tax-free withdrawals: Withdrawals for qualified medical expenses are tax-free.

Tax-free earnings: Interest and other earnings on the HSA are tax-free.

Claiming the Deduction

To claim the HSA deduction, you must file IRS Form 8889 with your tax return. This form has three parts:

Part I: Reports your HSA contributions.

Part II: Calculates your HSA deduction.

Part III: Reports distributions from your HSA.

Additional Information

Catch-up contributions: Individuals aged 55 and older can make additional catch-up contributions.

IRS guidelines: For detailed information, refer to IRS Publication 969 and the relevant IRS notices for the tax year.

Types of HSA’s

HSAs can be opened through banks, insurance companies, or employer-sponsored programs. Each type may offer different features and benefits.

Conclusion

The HSA deduction for 2023 can be a significant tax-saving opportunity for those with high-deductible health plans. By understanding the eligibility requirements and how to claim the deduction, you can make informed decisions that benefit your financial health.