The 2023 Small Employer Pension Startup Costs Credit: A Simple Guide

Introduction

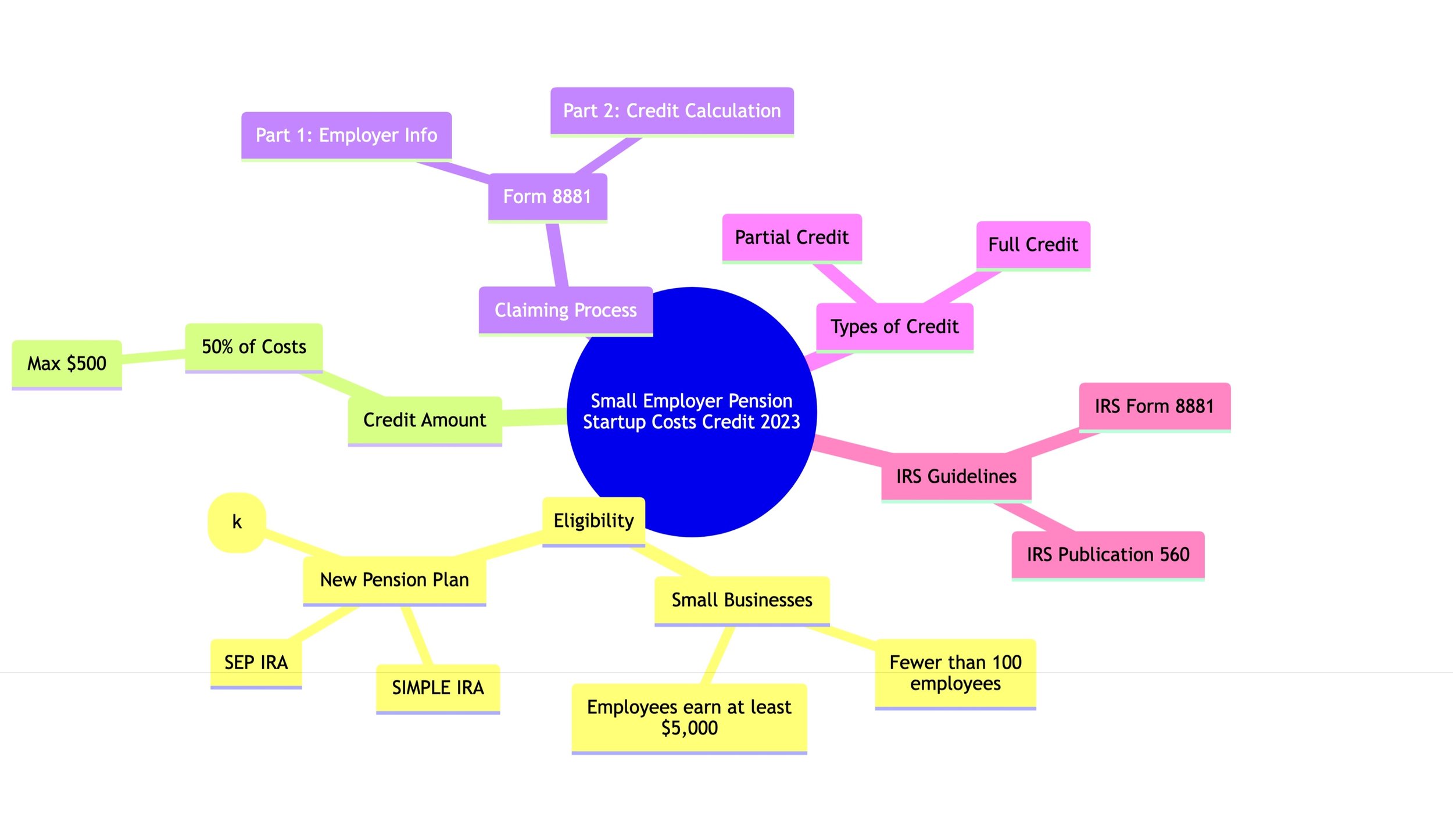

The Small Employer Pension Startup Costs Credit is a federal tax incentive aimed at encouraging small businesses to set up retirement plans for their employees. This article will walk you through the eligibility criteria, credit amount, and the process to claim this credit for the 2023 tax year.

Eligibility

Small Businesses

Employee Count: Businesses with fewer than 100 employees are eligible.

Employee Earnings: Employees must earn at least $5,000 annually.

New Pension Plans

Types of Plans: SIMPLE IRA, SEP IRA, and 401(k) plans are eligible.

New Plans Only: The credit is available for newly established plans.

Credit Amount

Percentage: The credit covers 50% of the startup costs.

Maximum Limit: The maximum credit amount is $500.

How to Claim

IRS Form 8881

Part 1: Employer Information

Business name, EIN, and other basic details.

Part 2: Credit Calculation

Details of the startup costs and the credit amount.

Types of Credit

Full Credit: Available for employers who meet all the eligibility criteria.

Partial Credit: Available for those who meet some but not all criteria.

IRS Guidelines

For more details, consult IRS Form 8881 and IRS Publication 560.

Common Pitfalls

Incorrect Filing: Ensure that you fill out Form 8881 accurately to avoid delays or denials.

Documentation: Keep all relevant records to substantiate your claim.

Conclusion

The Small Employer Pension Startup Costs Credit is a valuable opportunity for small businesses to offer retirement benefits to their employees while also benefiting from a tax credit. Understanding the eligibility and claiming process can help you make the most of this financial incentive.