Understanding Material and Active Participation: Benefits, Eligibility, and How to Claim

Introduction

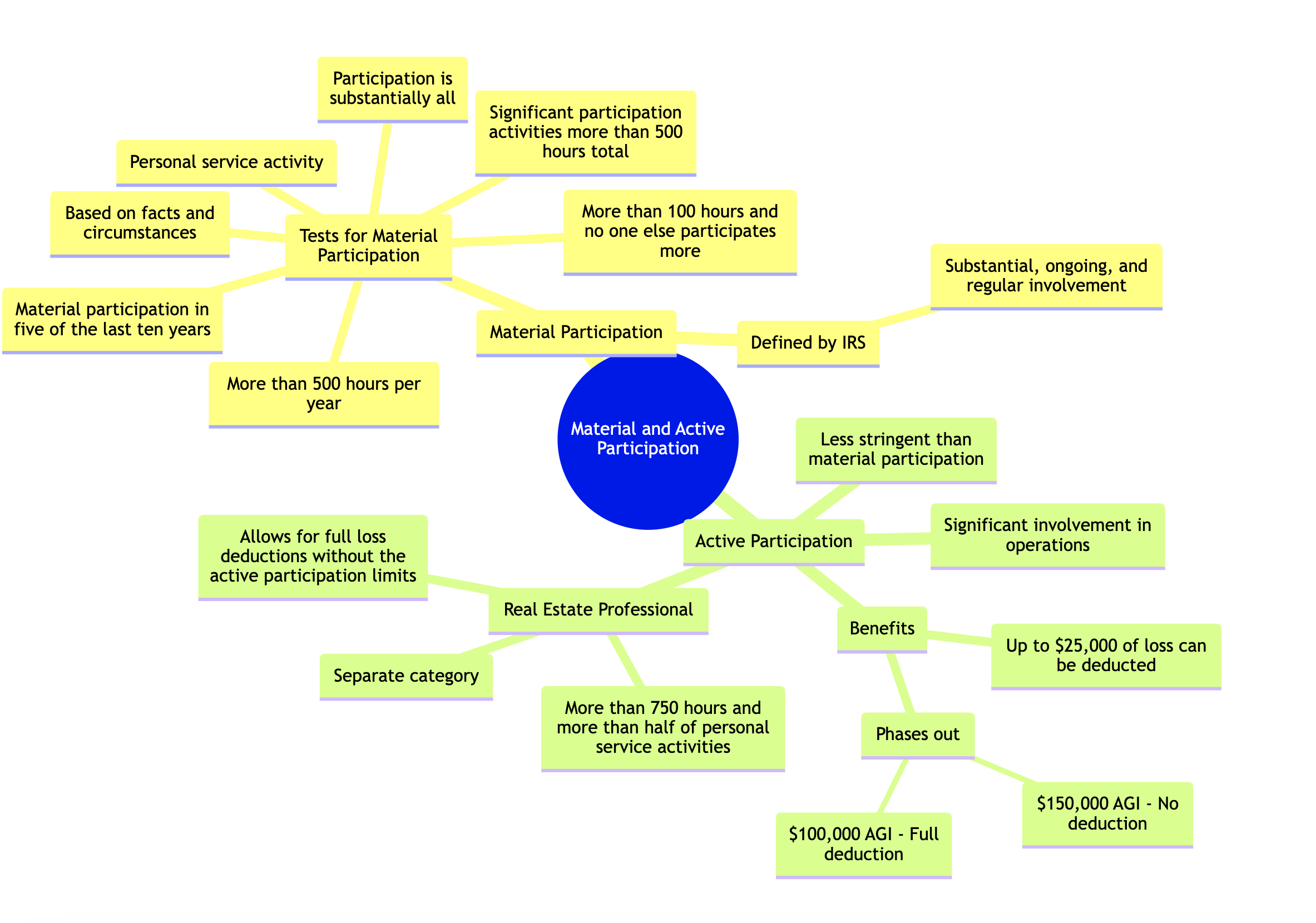

For real estate investors, navigating the tax implications of rental properties is crucial. The IRS distinguishes between passive and non-passive income and losses, with significant tax benefits available through material and active participation. Understanding these concepts can help investors strategically manage their properties and optimize tax outcomes.

Material Participation: Unlocking Non-Passive Income Benefits

What Is Material Participation?

Material participation means being actively involved in the operations of your real estate business to the extent that the IRS considers the income generated as non-passive. This classification allows investors to deduct any losses incurred from the property against other non-passive income, potentially lowering overall tax liability.

Requirements for Material Participation

The IRS outlines seven tests for material participation, including:

500-Hour Test: You work on the activity for more than 500 hours during the tax year.

Substantial Participation Test: Your participation is substantial, and no one else works more hours than you.

100-Hour Test: You work at least 100 hours, and your participation isn't less than the participation of any other individual.

Significant Participation Activities (SPAs): You participate in multiple activities, each more than 100 hours, totaling more than 500 hours.

Material Participation in Five of Ten Previous Years: For any five of the ten tax years immediately preceding the current tax year.

Personal Service Activities: If the activity is a personal service activity, you materially participated for any three prior tax years.

Based on Facts and Circumstances: You participate on a regular, continuous, and substantial basis during the year.

How to Claim

Documentation: Keep detailed logs of your activities and hours.

Tax Filing: Report your income and losses on Schedule E of Form 1040 and use Form 8582 to report and apply passive activity loss limitations.

Active Participation: Easing into Real Estate Investments

What Is Active Participation?

Active participation is a less stringent standard than material participation. It requires making management decisions such as approving new tenants, deciding rental terms, and authorizing repairs. This status allows for a special deduction against ordinary income.

Requirements for Active Participation

Ownership: You must own at least 10% of the property.

Management Decisions: Making managerial decisions qualifies as active participation, even if you do not spend a significant amount of time on the property.

Benefits

Special Loss Deduction: Qualify to deduct up to $25,000 in losses against your ordinary income, subject to phase-out starting at a modified adjusted gross income (MAGI) of $100,000 and completely phased out at $150,000.

How to Claim

Record-Keeping: Document your ownership percentage and decisions made regarding the property.

Tax Filing: Claim the deduction on Schedule E and ensure your MAGI allows for the deduction.

Conclusion

Understanding and meeting the requirements for material or active participation can significantly impact your tax situation as a real estate investor. These strategies not only offer potential tax savings but also encourage hands-on involvement in property management. Always consult with a tax professional to ensure compliance and to strategize the best approach for your investment portfolio.